vNigeria’s capital market regulator outlines 5-point agenda to boost investor confidence

To better position Nigeria’s capital market and restore investor confidence, the Securities and Exchange Commission (SEC) said it has rolled out a five-point agenda.

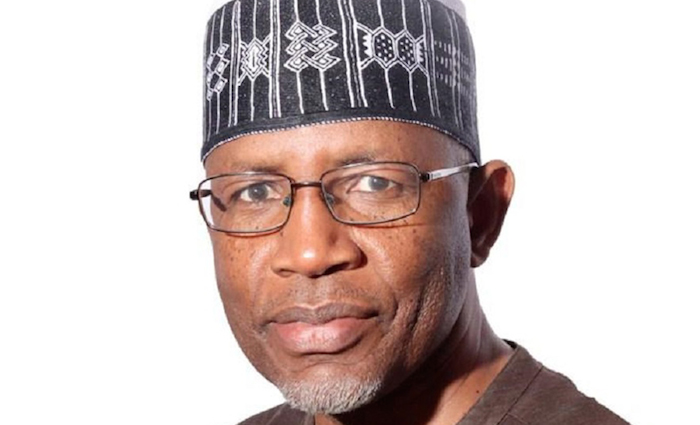

Lamido Yuguda, director general of the SEC, made this known on Thursday at a fireside chat during the 8th edition of BusinessDay’s Investing and Capital Market conference.

“We have identified as key priorities a five-point agenda for Nigeria’s capital market,” said Yuguda, who assumed office July 6, 2020 with a brand-new management team for the commission.

According to the DG, the first on the list of the agenda is to boost the commission’s operational efficiency.

“The commission needs to be sound in other to provide the regulatory support that the market needs,” he said. “The second is the continued implementation of the capital market master plan (2015-2025).”

Returning investor confidence is the third item on the agenda listed by Yuguda. Nigerian capital market has seen a lot of investors leave the market in the past 10 years and since the last global financial crisis.

“We have less than 400 thousand CIS accounts in Nigeria, for a population that is over 200 million. So that means that there is a significant amount of work that needs to be done to increase the take up of investment product among our population”, Yuguda explained.

According to the DG, the commission also wants to improve investor experience.

”You will agree with me that capital market transactions are not exactly easy at the moment. It is easier for you to open a banking account. We want to simplify this process so that the experience of investors is really kind of seamless”.